Are you feeling overwhelmed by financial concerns? Whatever your circumstances, there are ways to get through these difficult economic times, reduce stress and anxiety, and regain financial control.

Money worries can have a negative impact on your sleep, self-esteem, and energy levels. It can leave you feeling angry, ashamed, or fearful, exacerbate pain and mood swings, and even increase your risk of depression and anxiety.

Recognizing Financial Stress.

You are not alone in your financial concerns. At this difficult time, many of us from all over the world and from all walks of life are dealing with financial stress and uncertainty. Financial worry is one of the most common stressors in modern life, whether it is caused by a loss of employment, escalating debt, freezing your incoming income, unexpected expenses, or a combination of factors. Even before the global coronavirus pandemic and its economic ramifications. Because of the recent economic difficulties, an increasing number of people are now facing financial difficulties and hardship.

Financial problems, like any other source of overwhelming stress, can have a significant impact on your mental and physical health, relationships, and overall quality of life. Money worries can have a negative impact on your sleep, self-esteem, and energy levels. It can leave you feeling angry, ashamed, or fearful, exacerbate pain and mood swings, and even increase your risk of depression and anxiety. To try to escape your worries, you may resort to unhealthy coping mechanisms such as drinking, drug abuse, manipulating someone for money, or gambling. Financial stress can even lead to suicidal thoughts or actions in the worst-case scenario. But, no matter how hopeless your situation appears to be, there is assistance available. By confronting your financial issues head on, you can find a way out of the financial quagmire, reduce your stress, and regain control of your finances—and your life.

Financial Stress Has A Negative Impact On Your Health.

While we all know there are far more important things in life than money, when you’re struggling financially, fear and stress can take over. It can lower your self-esteem, make you feel flawed, and fill you with hopelessness. When financial stress becomes too much, your mind, body, and social life can suffer.

Financial Stress Can Result In…

Insomnia or other sleep problems Worrying about unpaid bills or a loss of income will keep you awake at night more than anything else.

Gaining weight (or loss). Stress can affect your appetite, causing you to overeat or skip meals in order to save money.

Depression. Living under the shadow of financial problems can leave anyone feeling depressed, hopeless, and unable to concentrate or make decisions. People who are in debt are more than twice as likely to be depressed.

Anxiety. Money can serve as a safety net; without it, you may feel exposed and anxious. Worrying about unpaid bills or income loss can cause anxiety symptoms such as a racing heart, sweating, shaking, or even panic attacks.

Difficulties in relationships. Money is frequently cited as the most common source of conflict between couples. Financial stress, if left unchecked, can make you angry and irritable, cause a loss of interest in sex, and erode the foundations of even the strongest relationships.

Withdrawal from social activities. Financial concerns can clip your wings, causing you to withdraw from friends, limit your social life, and retreat into your shell—all of which will exacerbate your stress.

Physical ailments such as headaches, gastrointestinal issues, diabetes, itching (pruritis), high blood pressure, and heart disease are examples of physical ailments. Money worries may also cause you to delay or skip seeing a doctor in countries where healthcare is not provided for free.

Unhealthy coping mechanisms, such as excessive drinking, prescription or illegal drug abuse, gambling, or overeating. Money worries can even lead to self-harm or suicidal ideation.

The vicious circle of poor financial and mental health.

Several studies have found a cyclical relationship between financial concerns and mental health issues such as depression, anxiety, and substance abuse.

Financial difficulties have a negative impact on your mental health. You may feel depressed or anxious as a result of the stress of debt or other financial issues.

Money management becomes more difficult as your mental health deteriorates. You may find it difficult to concentrate or lack the energy to deal with a growing pile of bills. You may also lose income if you miss work due to anxiety or depression.

These money management difficulties lead to more financial problems and worsening mental health problems, and so on. You become trapped in a downward spiral of increasing financial difficulties and deteriorating mental health.

Whatever your current situation may appear to be, there is a way out. These strategies can assist you in breaking the cycle, relieving the stress of money problems, and regaining stability.

Managing Financial Stress.

Speak With Someone.

When you’re dealing with money issues, it’s easy to bottle everything up and try to go it alone. Many of us consider money to be a taboo subject, one that should not be discussed with others. You may be uncomfortable disclosing how much you earn or spend, ashamed of any financial mistakes you’ve made, or embarrassed about not being able to provide for your family. But burying your feelings will only make your financial situation worse. In today’s economy, where many people are struggling through no fault of their own, you’ll likely find that others are far more understanding of your difficulties.

Not only is talking face-to-face with a trusted friend or loved one a proven stress reliever, but discussing your financial problems openly can also help you put things into perspective. Keeping your financial worries to yourself only exacerbates them until they appear insurmountable. Simply expressing your concerns to someone you trust can make them appear far less intimidating.

-The person you speak with does not have to be able to solve your problems or provide financial assistance.

-They only need to be willing to talk things out without judging or criticising to relieve your burden.

-Be open and honest about what you’re going through and your emotions.

-Talking about your concerns can help you make sense of what you’re going through, and your friend or loved one may be able to suggest solutions that you hadn’t considered on your own.

Getting Professional Help.

Getting practical advice from an expert is always a good idea, whether or not you have a friend or loved one to talk to for emotional support. Reaching out is not a sign of weakness, nor does it indicate that you have failed as a provider, parent, or spouse. It simply means you’re wise enough to recognise that your financial situation is causing you stress and that it needs to be addressed.

Disclosing Yourself To Your Family.

Financial problems tend to affect the entire family, and enlisting the help of your loved ones can be critical in turning things around. Even if you take pride in your independence, keep your family informed of your financial situation and how they can assist you in saving money.

Allow them to air their grievances. Your family members are probably concerned about you and the financial stability of your family unit. Listen to their concerns and allow them to make suggestions on how to solve your financial problems.

Make time for (cheap) family fun. Set aside regular time to enjoy each other’s company, unwind, and forget about your financial worries. Walking in the park, playing games, or exercising as a family does not have to be expensive, but it can help relieve stress and keep the entire family positive.

Take Stock Of Your Finances.

Keep track of EVERYTHING you spend. When you’re dealing with a mountain of overdue bills and mounting debt, buying a coffee on the way to work may seem like a frivolous expense. However, seemingly insignificant expenses can quickly add up, so keep track of everything. Understanding how you spend your money is essential for budgeting and developing a plan to address your financial issues.

List all of your debts. Include past-due bills, late fees, minimum payments due, and any money owed to family or friends.

Determine your spending patterns and triggers. Is it boredom or a stressful day at work that drives you to the mall or online shopping? Do you feed your children expensive restaurant or takeout meals when they are misbehaving, rather than cooking at home? Do you spend money on your relatives’ children because you adore them? Once you’ve identified your triggers, you can find healthier ways to deal with them rather than resorting to “retail therapy.”

Consider making small changes. Purchasing items such as a morning newspaper, a lunchtime sandwich, or break-time snacks can add up to a significant monthly outlay. While it may be unreasonable to deny yourself every small pleasure, cutting back on unnecessary spending and finding small ways to reduce your daily expenditure can help you free up extra cash to pay off bills.

Reduce your impulsive spending. Have you ever seen something online or in a store window that you simply had to have? Impulsive purchases can devastate your budget and max out your credit cards. To break the habit, make it a rule to wait a week before making a new purchase.

Take it easy on yourself. As you examine your debt and spending habits, keep in mind that anyone can run into financial difficulties, especially in these trying times. Don’t use this as an excuse to punish yourself for perceived financial miscalculations. As you look to move forward, give yourself a break and concentrate on the aspects you can control.

Make A Strategy—And Stick To It.

If you’ve taken stock of your financial situation, eliminated discretionary and impulse spending, and your outgoings continue to exceed your income, you have three options: increase your income, reduce your spending, or do both. Making a plan and following through on it will be required to achieve any of those goals.

Determine your financial issue. After taking inventory, you should be able to clearly identify the financial issue you’re dealing with. You may have too much credit card debt, insufficient income, or you overspend on unnecessary purchases when stressed or anxious. Or maybe it’s a combination of issues. Make a distinct plan for each.

Create a solution. Brainstorm ideas with your family or a trusted friend, or seek free financial advice. You may decide that contacting credit card companies and requesting a lower interest rate would be beneficial in resolving your issue. Perhaps you need to restructure your debt, eliminate your car payment, downsize your home, or discuss working overtime with your boss.

Put your strategy into action. Be specific about how you intend to implement the solutions you’ve devised. Perhaps this entails cancelling credit cards or networking for a new job or leads.

Keep track of your progress. As we’ve all seen recently, events that affect your financial health can occur quickly, so it’s critical to review your plan on a regular basis. Are some aspects more effective than others? Do changes in interest rates, monthly expenses, or hourly wage, for example, necessitate a revision of your plan?

Setbacks should not derail you. We’re all human, and no matter how well you plan, you may deviate from your objective or something unexpected may occur to derail you. Don’t be too hard on yourself, but get back on track as soon as possible.

The more specific your plan, the less powerless you will feel over your financial situation.

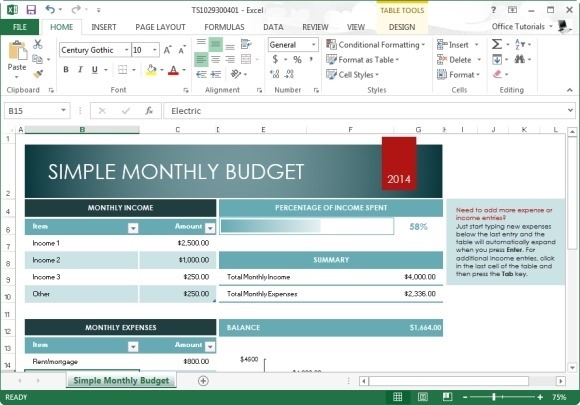

Make A Monthly Spending Plan.

Whatever your plan for resolving your financial issues, creating and sticking to a monthly budget can help you stay on track and regain control.

-Include in your budget daily expenses such as groceries and transportation to work, as well as monthly rent, mortgage, and utility bills.

-Divide items that you pay annually, such as car insurance or property tax, by 12 to set aside money each month.

-If at all possible, budget for unexpected expenses such as a medical co-pay or prescription charge if you become ill, or the cost of home or car repairs.

-Whenever possible, set up automatic payments to help ensure bills are paid on time and to avoid late payments and interest rate increases.

-Organize your spending. If you’re having trouble covering your monthly expenses, prioritising where your money goes first can help. Feeding and housing yourself and your family, as well as keeping the power on, are examples of necessities. Even if you’re behind on your payments and are being harassed by debt collectors, paying your credit card isn’t.

-Continue to look for ways to save money. Most of us can find something in our budget to cut to help us make ends meet. Review your budget on a regular basis and look for ways to cut costs.

-Enlist the help of your spouse, partner, or children. Make sure everyone in your household is pulling in the same direction and understands your financial goals.

Control Your Overall Stress.

Resolving financial issues usually entails small steps that pay off in the long run. Your financial difficulties are unlikely to disappear overnight in the current economic climate. But that doesn’t mean you can’t take immediate steps to reduce your stress and find the energy and peace of mind you need to deal with challenges in the long run.

Get your feet moving. Even a small amount of regular exercise can help relieve stress, improve your mood and energy, and boost your self-esteem. On most days, aim for 30 minutes, which can be broken up into short 10-minute bursts if necessary.

Use a relaxation technique. Take some time each day to unwind and give your mind a break from the constant worrying.Meditation, breathing exercises, and other relaxation techniques are excellent ways to relieve stress and rebalance your life.

Don’t short-change yourself on sleep. Tiredness will only add to your stress and negative thought patterns. During this difficult time, finding ways to improve your sleep will benefit both your mind and body.

Improve your self-esteem. Financial problems, whether right or wrong, can make you feel like a failure and harm your self-esteem. However, there are numerous other, more rewarding ways to boost your self-esteem. Even if you’re struggling yourself, guiding others can boost your confidence and relieve stress, anger, and anxiety—not to mention help a worthy cause. You could also spend time in nature, learn a new skill, or spend time with people who value you for who you are rather than your bank balance.

Consume nutritious foods. A healthy diet rich in fruits, vegetables, and omega-3 fatty acids can help support your mood while also increasing your energy and outlook. And you don’t have to break the bank to eat well; there are ways to eat well on a budget.

Be thankful for the blessings in your life. When you’re plagued by money worries and financial insecurity, it’s easy to fixate on the negatives. While you don’t have to pretend everything is fine, you can take a moment to appreciate a close relationship, the beauty of a sunset, or the love of a pet, for example. It can distract your mind from constant worrying, improve your mood, and relieve stress.

For Inner Strength, Read Spiritual Books.

Having faith in the Divine or Master also helps to keep you energized. All of the benefits of salvation are brought into our lives through faith. This includes healing, prosperity, peace, love, joy, deliverance from demons and the curse, sanctification of the mind and emotions (soul salvation), and any other benefit promised to us by God’s word.

Faith communicates in the language of the heart. It is a hope-filled expression that goes beyond the conscious mind.

Discover more from Parth Sharma

Subscribe to get the latest posts sent to your email.

This is great advice.

LikeLiked by 1 person

I think part of the problem is that talking about money is such a taboo still. Plus, women are a disadvantage with the “motherhood penalty,” wage inequality, and more. There’s so much to think about, no wonder people are stressed! A demon, as you say.

LikeLiked by 1 person

Excellent, exhaustive analysis with solutions. 👍

LikeLiked by 1 person